What Is The Sales Tax On Used Cars In Ontario . the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. As with other uses of the. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the.

from learningcotarjm.z14.web.core.windows.net

This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. As with other uses of the. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car.

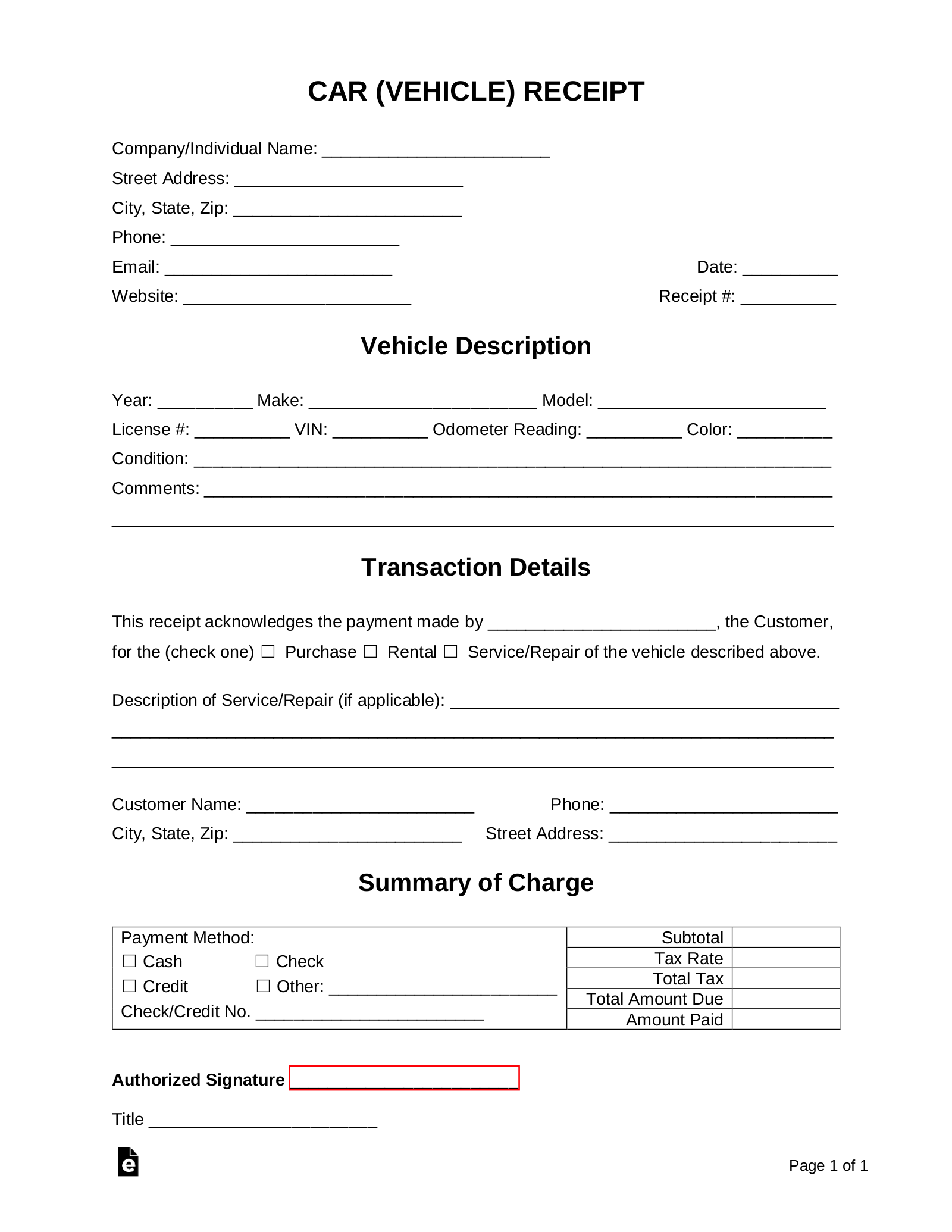

Printable Vehicle Sales Receipt

What Is The Sales Tax On Used Cars In Ontario yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. As with other uses of the. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government.

From taxfoundation.org

State and Local Sales Tax Rates Sales Taxes Tax Foundation What Is The Sales Tax On Used Cars In Ontario when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. car buyers pay 13% sales tax in ontario based on the purchase price of. What Is The Sales Tax On Used Cars In Ontario.

From hxejbgmbe.blob.core.windows.net

How To Buy A Used Car In Ottawa at Debra Matas blog What Is The Sales Tax On Used Cars In Ontario As with other uses of the. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. the ontario tax on used vehicles is 13%, with. What Is The Sales Tax On Used Cars In Ontario.

From aubinevhillary.pages.dev

2024 Mustang For Sale Ontario Ertha Lorelle What Is The Sales Tax On Used Cars In Ontario car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the. What Is The Sales Tax On Used Cars In Ontario.

From exoplzjjb.blob.core.windows.net

Buy Sale Trade Car Lots Near Me at Dennis Wells blog What Is The Sales Tax On Used Cars In Ontario car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. As with other uses of the. when you buy a used. What Is The Sales Tax On Used Cars In Ontario.

From www.carsalerental.com

Selling A Used Car In Ontario Bill Of Sale Car Sale and Rentals What Is The Sales Tax On Used Cars In Ontario this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of. What Is The Sales Tax On Used Cars In Ontario.

From dxobodalh.blob.core.windows.net

How Is Sales Tax Calculated On A Used Car In Ontario at Scott McKinney blog What Is The Sales Tax On Used Cars In Ontario when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to. What Is The Sales Tax On Used Cars In Ontario.

From privateauto.com

How Much are Used Car Sales Taxes in Indiana? What Is The Sales Tax On Used Cars In Ontario the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. As with other uses of the. this page explains how retail sales. What Is The Sales Tax On Used Cars In Ontario.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals What Is The Sales Tax On Used Cars In Ontario when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst. What Is The Sales Tax On Used Cars In Ontario.

From old.sermitsiaq.ag

Car Sales Text Templates What Is The Sales Tax On Used Cars In Ontario As with other uses of the. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. This is a free tool to help estimate the provincial/territorial and federal taxes. What Is The Sales Tax On Used Cars In Ontario.

From www.carsalerental.com

How Much Sales Tax On A Used Car In Ontario Car Sale and Rentals What Is The Sales Tax On Used Cars In Ontario the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. this page explains how retail sales tax (rst) applies to specified vehicles purchased privately. What Is The Sales Tax On Used Cars In Ontario.

From www.youtube.com

How to Calculate Sales Tax on used Cars in Pakistan YouTube What Is The Sales Tax On Used Cars In Ontario when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. As with. What Is The Sales Tax On Used Cars In Ontario.

From www.mychoice.ca

Car Bill of Sale in Ontario? MyChoice What Is The Sales Tax On Used Cars In Ontario when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase. What Is The Sales Tax On Used Cars In Ontario.

From taxsaversonline.com

Do You Have to Pay Sales Tax on Used Car? What Is The Sales Tax On Used Cars In Ontario As with other uses of the. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales. What Is The Sales Tax On Used Cars In Ontario.

From dxohxgnmh.blob.core.windows.net

What Is The Sales Tax On 59 99 at Laurie Mikkelson blog What Is The Sales Tax On Used Cars In Ontario car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the. What Is The Sales Tax On Used Cars In Ontario.

From www.sellmycar.ca

How to Sell Your Car in Ontario A StepbyStep Guide What Is The Sales Tax On Used Cars In Ontario yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. when you buy a used car in ontario, you’ll need to pay the hst (harmonized. What Is The Sales Tax On Used Cars In Ontario.

From publiccarauctionscalifornia.com

Sales Tax on Used Cars in California Auto Auctions California What Is The Sales Tax On Used Cars In Ontario when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. . What Is The Sales Tax On Used Cars In Ontario.

From blog.clutch.ca

The Ultimate Guide To Buying a Used Car in Ontario Clutch Blog What Is The Sales Tax On Used Cars In Ontario This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to. What Is The Sales Tax On Used Cars In Ontario.

From exornsgyz.blob.core.windows.net

Sales Tax On Used Cars In New Brunswick at Roger Oyer blog What Is The Sales Tax On Used Cars In Ontario when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. this page explains how retail sales tax (rst) applies to specified vehicles purchased privately in ontario or that are. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle. when. What Is The Sales Tax On Used Cars In Ontario.